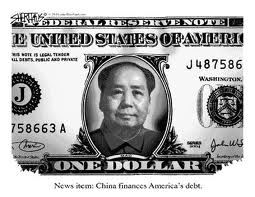

A profound social transformation has been taking place right in front of us, and we have barely noticed. Very quietly a revolution in attitude has occurred. It is simply this: debt has been normalized. As a professor I see it every day where students preparing for the (generally underpaid) Christian ministry blithely assume enormous debt to finance their seminary education. They are in effect committing themselves to long-term financial hardship. In some cases their only hope will be to declare chapter 7 bankruptcies. But this is simply a reflection at the personal level of a much larger national disposition. America is staggering toward its own bankruptcy, and we cannot seem to get a handle on the problem. This week I discovered another reasons why our growing debt should be a particular concern for Christians. It came out of a news report from China.

During the last several months the government of China is once again flexing its muscle, and exercising brutal control of its population. One of the ways it is doing this is to crack down on Christians who dare to express their God-given freedom to worship according to their consciences. Their churches are being shut down and they are being herded into police stations, detained and intimidated. In the past these ham-fisted reactions have been restrained by a fear of international disapproval, but the new element in the equation is a bold Chinese disregard for what the United States or any human rights organization thinks. As a recent NPR report from Beijing notes, China no longer cares what the United States or the outside world thinks.

For the latest abuse of an unregistered church, see:

http://www.npr.org/2011/04/11/135305676/china-cracks-down-on-christians-at-outdoor-service

Why is this? It is because China is well on its way to owning us. There is a timeless piece of wisdom in the biblical Book of Proverbs, which reads: “The borrower is slave to the lender” (Prov. 22:7). It’s always been this way—debt is disempowering. The lender always rules over those who owe them money. And this is already having a profound effect on the ability of freedom-loving Christians to speak out effectively against the suppression of the religious freedom of others.

Ultimately China is not the enemy. Our debt is, and the spirit of greedy irresponsibility that feeds it. Is debt a moral and religious issue? You bet it is.

7 Responses to Financial Debt and Religious Freedom